DeFiMatrix.io delivers autonomous AI-driven DeFi, enabling intelligent capital deployment, automated portfolios, and seamless optimization across digital payments, DeFi banking, and blockchain ecosystems.

Trusted by DeFi users in 150+ countries.

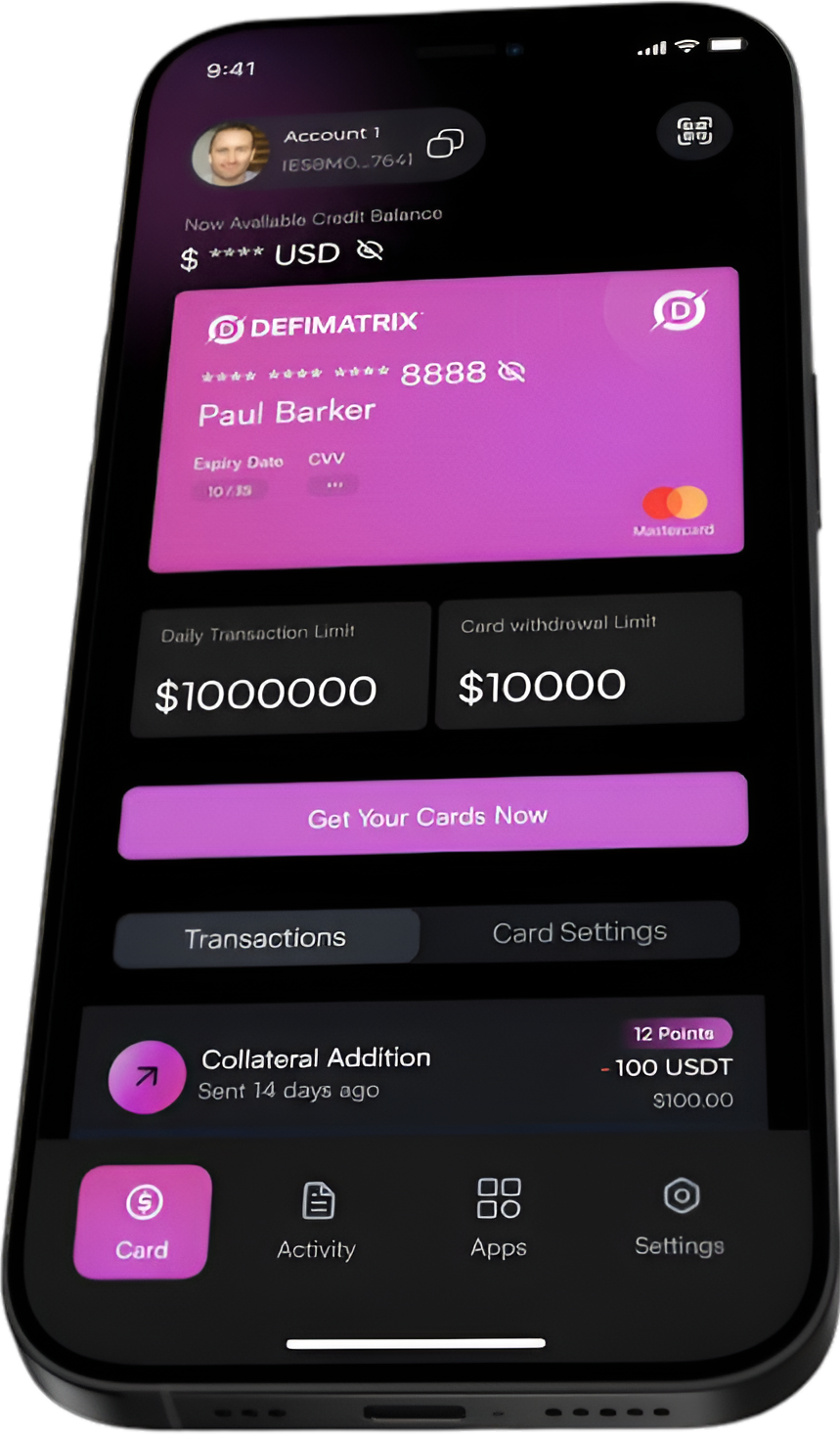

DeFiMatrix offers the fastest and most seamless way to use your crypto like cash — anytime, anywhere.

The world's most innovative and trusted companies work with DeFiMatrix.

We're proud to launch Defimatrix, An AI-powered yield optimizer that merges institutional-grade strategy with effortless DeFi automation.

Automated Single-Chain Yield Agent dynamically manages and compounds your assets across whitelisted protocols to maximize returns—no manual effort required.

Define your yield target (e.g., Optimize Arbitrum stablecoin APY) via intuitive onboarding. Our AI agent executes and auto-compounds rewards securely.

Join community-governed vaults with real-time action logs. Stake tokens, vote on strategies, and track performance via an audited dashboard.

Provide liquidity to pre-vetted protocols. Rewards are harvested and reinvested autonomously by the AI agent for optimal growth.

Gain early entry to audited, high-potential DeFi projects. Whitelisted protocols launch monthly, integrated with yield automation.

AI-Optimized DeFi, Simplified

Achieve maximum yields effortlessly. Let our AI agent automate strategies while you retain full control.

AI-Powered Cross-Chain Yield Bridge

Our AI agent automatically bridges and deploys your assets across chains to optimize yield opportunities while minimizing gas costs.

Autonomous Token Swaps

Let our AI agent execute the most efficient swaps across whitelisted protocols, finding optimal pricing and timing for your transactions.

Fiat Gateway

Coming Soon: Our AI will automatically convert fiat to the highest-yielding tokens and vice versa based on real-time market conditions.

AI Agent Command Center

Coming Soon: Directly command your AI yield agent via chat interface - monitor, adjust, and optimize your portfolio through conversational DeFi.

Autonomous

DeFi Agent

Self-optimizing yield engine that continuously analyzes, executes, and compounds across chains, with institutional-grade security and full user control.

Smart AI Driven Strategies

Secure Audited Solutions

Makes us

UNIQUE

AI-Powered Autopilot Portfolios

One click deploys your capital - our agent automatically allocates, optimizes, and compounds yields across 100+ vetted protocols 24/7.

Banking-Simple DeFi

Manage your crypto like checking your balance - our AI handles the complex yield strategies behind one intuitive interface.

AI-Powered Transaction Supercharger

Our autonomous agent compresses hours of complex DeFi actions into one tap, executing swaps, bridges, and yield moves at machine speed.

AI-Streamlined DeFi Execution

Describe your goal in plain English - our autonomous agent handles all complex transactions in one click at blockchain speed.

Supported on 67+

chains

AI-Powered Strategies

Experience autonomous DeFi optimization where plain-English goals transform into high-yield strategies. Our AI agent builds and manages sustainable portfolios while maximizing utility for $DMX holders.

AI Optimization

AI Optimization AI for Yield Optimization

AI for Yield OptimizationDeFiMatrix employs advanced AI technology to automate and refine yield strategies across various blockchains. This ensures that strategies are dynamically adjusted to market conditions, maximizing returns for its users.

Platforms:

Stablecoin Yields

Stablecoin Yields Stablecoin Yield Strategies

Stablecoin Yield StrategiesLeveraging time-tested methods, DeFiMatrix promises stable and predictable returns through stablecoin lending and liquidity provision, offering a solid foundation for yield generation within the DeFi ecosystem.

Platforms:

Asset Tokenization

Asset Tokenization Tokenizing Real Assets

Tokenizing Real AssetsDeFiMatrix is expanding the DeFi investment horizon by tokenizing real-world assets. This innovative move allows for yield generation from tangible assets such as real estate and commodities, broadening the scope of DeFi investments.

Platforms:

Bond Strategies

Bond Strategies Bonds for Yield & Bond Strategies

Bonds for Yield & Bond StrategiesIn a groundbreaking move, DeFiMatrix merges traditional financial mechanisms with the dynamic world of DeFi, utilizing bonds to introduce a stable and reliable return channel through unique bonding mechanisms.

Platforms:

Options Trading

Options Trading Structured Products via Options

Structured Products via OptionsOffering sophisticated financial instruments, DeFiMatrix provides its users with options-based strategies, akin to those found on Ribbon Finance. This approach is designed for optimizing earnings and managing investment risks effectively.

Platforms:

NFT Finance

NFT Finance NFT-Fi for Yield & NFT Leverage

NFT-Fi for Yield & NFT LeverageDeFiMatrix is pioneering the integration of NFTs with finance (NFT-Fi), enabling yield generation through innovative NFT collateralization. This strategy taps into the intrinsic value of digital assets and art, unlocking new financial potentials.

Platforms:

Yield Exploration

Yield Exploration Diversifying Beyond Popular DeFi Protocols

Diversifying Beyond Popular DeFi ProtocolsDeFiMatrix embarks on a quest to uncover stable yield opportunities beyond familiar protocols such as Aave or Compound, with the goal of diversifying portfolios and enhancing financial stability for its users.

Platforms:

Risk Hedging

Risk Hedging Risk Management with Perps

Risk Management with PerpsWith a strategic use of perpetual contracts and delta-neutral strategies, DeFiMatrix aims to protect user investments from the crypto market's volatility, ensuring a more secure and stable investment environment.

Platforms:

Collateralization

Collateralization Liquidity via $DMX Collateralization

Liquidity via $DMX CollateralizationBy enabling $DMX token collateralization for lending and borrowing, DeFiMatrix enhances the token's utility, providing its holders with unprecedented liquidity and flexibility.

Platforms:

Portals are open across Defi

Become a liquidity provider, earn yield in vaults, lend your assets, swap any token, and more with DeFiMatrix-supported protocols

ApeSwap

BabyDogeSwap

Balancer

Baseswap

Beefy

Benqi

Biswap

COMPound

Curve

FRAX Swap

GEIST-token

GEIST

IronBank

MMFinance

Mdex

Nimiswap

PancakeSwap

PoolTogether

Quickswap

Radiant

ShibaSwap

SpookySwap

StakeDAO

Stargate

SushiSwap

The Granary

TraderJoe

Uniswap

Uwulend

Verse

Vesper

Aave

Arbitrum

Beets-X

CoinGecko

Convex

Flux Finance

RocketSwap

SwapBased

SwirlLend

Synth

Uniswap

Venus

Yearn CRV

Yearn

FAQs - Your Questions, Answered

Can't find the answer you're looking for? Reach out to our customer support team.

Get in touch

Contact us via email support@defimatrix.io

or X @DeFiMatrixOS